Your Next Dollar's Journey: The 3 Phase Roadmap to Financial Clarity

Think of your money like water flowing down a mountainside. Without intention, it finds the easiest path — sometimes pooling in convenient spots, sometimes rushing toward the unknown. But when you become the architect of that flow, designing thoughtful channels and purposeful destinations, something magical happens: your money begins working as hard as you do.

You've built something remarkable. Your practice thrives, your family flourishes, and those business expansion dreams are becoming reality. But here's what I've learned from brilliant entrepreneurs: success creates complexity, and complexity can make even the smartest people feel like they're solving a puzzle in the dark.

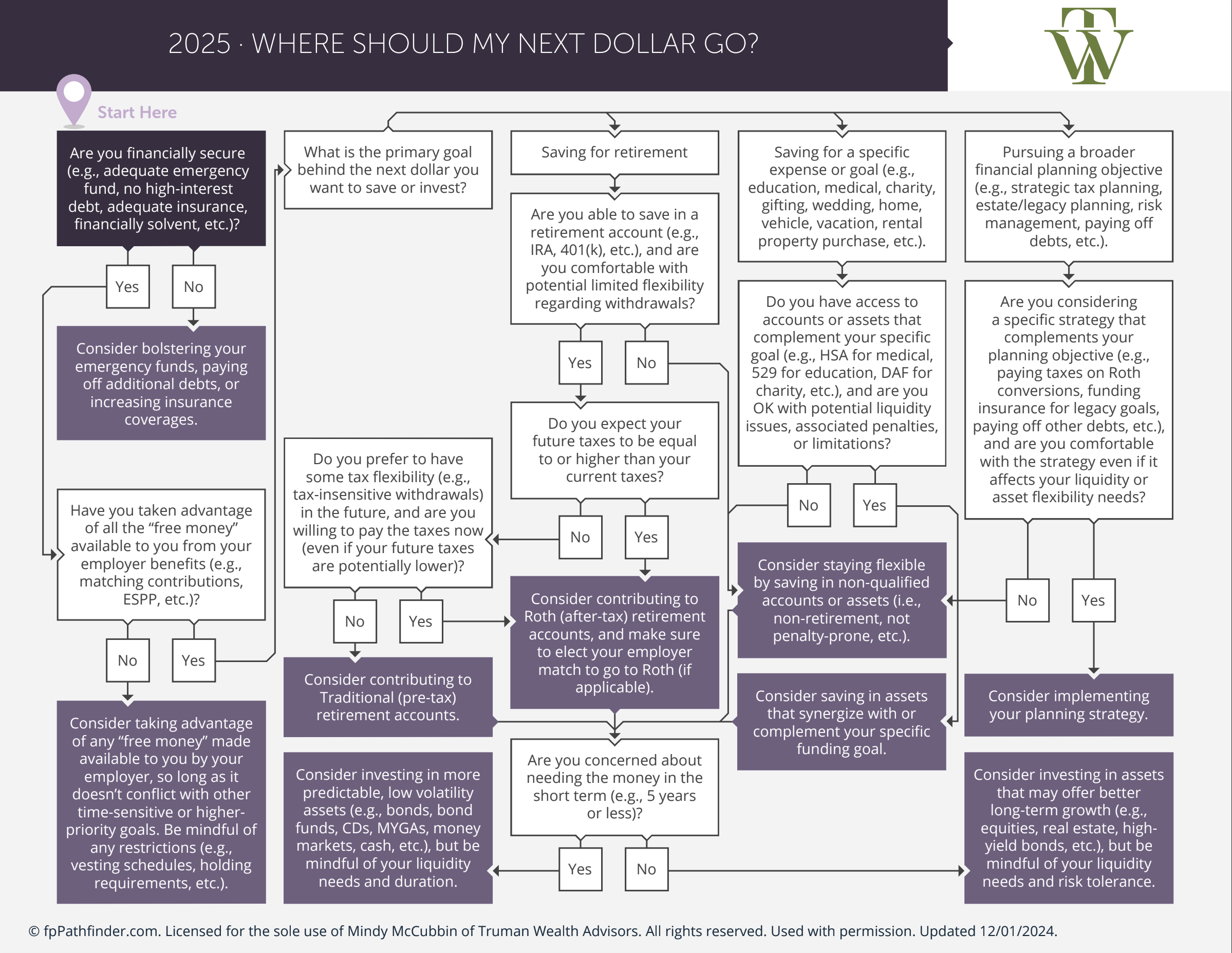

This is where our "Where Should My Next Dollar Go?" flowchart comes in handy. Think of it as your financial GPS — not because you're lost, but because you're going somewhere extraordinary and want to take possible.a route designed to align with your goals and risk tolerance.

Investment advisory services are offered through Truman Wealth Advisors, LLC, a registered investment advisor. Registration with the Securities and Exchange Commission or any state does not imply a certain level of skill or training.

The Foundation Phase: Your Financial Security Blanket

Just like a house needs solid bones before you add the beautiful fixtures, your financial plan begins with foundational elements. Are you financially prepared with adequate emergency funds, manageable debt, and proper insurance? If not, this is where your next dollars need to flow first. It's not glamorous, but it's the difference between building on rock versus sand.

Think of this phase like having the right safety gear before your next skiing adventure. You wouldn't hit the slopes without proper equipment, and you shouldn't pursue bigger financial goals without this foundation firmly in place.

The Growth Phase: Where Dreams Get Practical

Once your foundation is solid, the flowchart guides you through three beautiful pathways—like tributaries branching from your main financial river. Are you optimizing retirement savings? Funding specific goals like that medical spa equipment or your daughters' college funds? Or pursuing broader strategies that complement your evolving vision?

This isn't about choosing just one path. The most sophisticated financial plans, like the most beautiful gardens, have multiple elements working in harmony. Your Roth IRA contributions might bloom alongside your business expansion fund, while your children's education savings grow quietly in the background.

The Integration Phase: When It All Clicks

Here's where the magic happens—where your money stops feeling disjointed and starts feeling integrated with your lifestyle. When someone like you follows this flowchart, you're not just managing money; you're orchestrating a symphony where every dollar has its part to play.

The flowchart isn't rigid—it's responsive. As your business grows, as your family's needs evolve, as new opportunities arise, the path might shift. But the framework remains your north star, keeping you focused on what matters most.

Your Next Right Step

You don't need to have all the answers today. You just need to take the next right step. Whether that's bolstering your emergency fund, maximizing your retirement contributions, or strategically planning for your next business expansion, the flowchart meets you exactly where you are.

Because here's what we believe: true wealth isn't about accumulating the most money. It's about creating the freedom to live authentically, dream boldly, and know with confidence that money was never the obstacle — it was always the bridge to your biggest aspirations.

Live a wealth life, my friends.

Investment advisory services are offered through Truman Wealth, a registered investment advisor. This article is intended for informational and illustrative purposes only and should not be construed as personalized investment advice or a recommendation to buy or sell any security. The views expressed herein are those of the author and do not necessarily reflect the opinions of Truman Wealth. All investing involves risk including the possible loss of principal. Past performance is not indicative of future results. Readers should consult with a qualified financial professional before making any investment decisions.